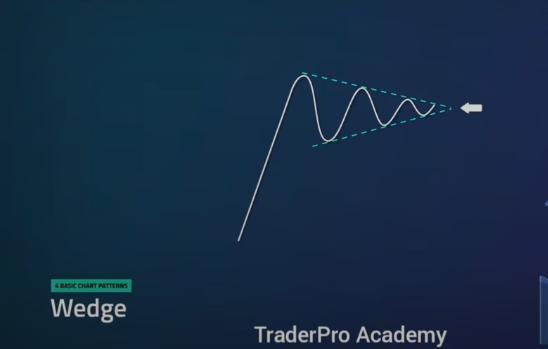

Wedge pattern is a pattern used in technical trading which essentially means using past repetitive data to predict how stock prices will move. Other technical trading patterns are flag, channel, and head and shoulders patterns.

Wedge pattern is most common in traded products such as bonds, futures, or stocks. It is defined by a price range that contracts and trends either upward or downwards. The upward trend is known as the rising wedge while the downward trend is known as the rising wedge. The pattern either forms at the top of the market trend or at the bottom.

In the wedge pattern, trading activities take place within two converging lines, leading to the formation of the pattern. It takes about 4 weeks before the wedge pattern is complete and the pattern consists of rising and falling slants. The difference between this pattern and a regular triangle is that the boundary lines slope either upwards or downwards. The breakout of price also shows another big difference.

Similar to the flag pattern, this formation consolidates towards the major break-out.

However, indecision is more prevalent here as buyers and sellers are matched, and the direction of the expansion is less certain.

The rising and falling wedges are just but a part of the major trend. Therefore, the wedge patterns are not major patterns. Whenever there is a continuation of the basic trend, the pattern seizes to be effective.

The Rising Wedge

This occurs when the market experiences higher lows and higher highs coupled with a contraction in wedge. If this pattern trends upwards, then the pattern is a reversal. The contraction will indicate that there is the loss of strength in the uptrend. On the other hand, when the pattern trends downwards then it becomes a bearish pattern. In this case, the range gets narrower, indicating loss of strength in the correction and that downtrend would resume.

In this wedge, the boundary lines are slanting up from right to left. However, the angle which the lower line makes as it rises is steeper than that of the upper line. Once prices break through the boundary line at the bottom, they decline. The decline goes on considering the volumes, indicating that the demand weakens when the price level is high. This wedge would be very reliable in a bearish trend than in a bullish trend.

Falling Wedge

It is defined when the market experiences lower highs and lower lows with contraction in wedge. When the pattern occurs in a downward trend, it becomes a reversal and there will be loss of strength indicated by the contracting range. When it experiences an upward trend then it becomes a bullish pattern. The range gets narrower indicating loss of strength as it moves into the correction after which the uptrend would resume.

In this wedge, the boundary lines are slanting down from right to left. The angle which the upper line makes as it descends is steeper than that of the lower line. The volume diminishes while the narrowing prices lead to slowing down of the trading activity. This becomes the breaking point and after the breakout has occurred, the trading activity differs. It is also important to know that the prices would likely move sideways and saucer-out after moving out of the boundary. Thereafter, they go back to the basic trend.