There are several different types of trading. A more common one is technical trading. Generally, this involves predicting what might happen to future stocks using historical data. The technician in this type of trading usually focuses more on the trends of the market rather than the products being traded.

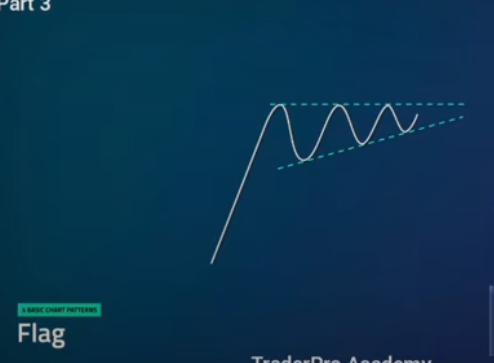

Now, in order for the technician to read the market, they look for trends in the past, and these are called patterns. We have a number of patterns, and today we will be looking at flag pattern.

Flag pattern is a price pattern that counters the long-time trend of the current price on the price chart. The flag pattern helps in the identification of the previous trend’s possible continuation after the drifting of price against the same trend.

In case the trend resumes, the price would increase rapidly making trade timing very advantageous since you can notice the flag pattern.

How Does a Flag Pattern Work?

The flags are simply where the price action is under tight consolidation. It shows a counter-trend movement following after the sharp directional price movement.

The price bars in this pattern are around five to twenty. Furthermore, the patterns can either experience an upward trend(bullish flag) or a downward trend(bearish flag) and the flag’s bottom shouldn’t go past the flagpole’s midpoint. Both the bearish and bullish patterns have the same structures in different trend directions.

The volume of the bullish pattern rises within the preceding trend but declines upon reaching the consolidation. On the contrary, the volume of the bearish patterns rises at first and then holds level. This is because the volume increases with progression in time.

Parallel markers on the chart would indicate the consolidation zone. At a point of convergence of the lines, the pattern would be called a pennant or wedge. These patterns are very reliable for traders. They generate an entry point into an already existing trend ready for continuation.

The flag pattern also follows the same break patterns and the same volume. It is defined by a trade volume that diminishes after increasing initially. The bottom lines in this pattern are very clear. Buyers and sellers are accumulating their positions in the anticipation of a break as price forms a tight wedge making the break-outs of this pattern some of the most powerful break-outs.

In this scenario, traders lack the urgency of continuing to sell or buy within the period of consolidation. Therefore, there would be a high possibility of new investors and traders taking over the trend and raising the prices at a high pace.

How do you trade using a flag pattern

Once you have identified the key points in this pattern, you can go ahead and establish a trading strategy. The key points are as follows;

- The entry- It is important that you wait until the initial breakout occurs before you continue with the current price trend. Traders often enter the flag once the price is broken and has closed above the parallel trend line at the top. For the bearish pattern, traders enter after the price closes below the parallel trend line at the bottom.

- The stop-loss point-Traders often take the stop-loss point as the side opposite to the flag pattern. They set the stop-loss point at a price level below that of the trend line at the bottom.

- The profit target- Most trades set their profit target from the difference between the two trend lines. Taking the measurements in price, they find the distance between the flagpole’s bottom and the high of the pattern.