Lumber prices have come full circle in the years following the pandemic — reaching record highs in 2021, then falling to record lows as higher interest rates led to a drop in U.S. residential construction. But there’s now an opportunity for buyers and homebuilders alike.

The dynamics of lumber pricing since the COVID-19 pandemic have, on balance, been “highlighted by a gradual weakening of demand from the frantic pace of a few years ago,” said Steve Loebner, vice president, forest products & risk management at Sherwood Lumber.

“The rapid rise in interest rates put additional significant downward pressure on demand by reducing the viability of commercial/multi-family projects, as well as stretching monthly mortgage payments to the point of unaffordability for a majority of people,” he told MarketWatch. The response in mill production has also not been “quick enough or deep enough” so far to offset lower demand.

On Tuesday, the September contract for lumber futures LBRU24, +1.42% LBR00, +1.42% on the CME traded at $468 per 1,000 board feet. Based on the most-active contract, prices have lost 13.9% so far this year, and marked a record intraday low of $440 on July 1, according to Dow Jones Market Data. Prices have declined 24.1% from this year’s peak in March.

Lumber prices have come full circle in the years following the pandemic — reaching record highs in 2021, then falling to record lows as higher interest rates led to a drop in U.S. residential construction. But there’s now an opportunity for buyers and homebuilders alike.

The dynamics of lumber pricing since the COVID-19 pandemic have, on balance, been “highlighted by a gradual weakening of demand from the frantic pace of a few years ago,” said Steve Loebner, vice president, forest products & risk management at Sherwood Lumber.

“The rapid rise in interest rates put additional significant downward pressure on demand by reducing the viability of commercial/multi-family projects, as well as stretching monthly mortgage payments to the point of unaffordability for a majority of people,” he told MarketWatch. The response in mill production has also not been “quick enough or deep enough” so far to offset lower demand.

On Tuesday, the September contract for lumber futures LBRU24, +1.42% LBR00, +1.42% on the CME traded at $468 per 1,000 board feet. Based on the most-active contract, prices have lost 13.9% so far this year, and marked a record intraday low of $440 on July 1, according to Dow Jones Market Data. Prices have declined 24.1% from this year’s peak in March.

2024July425450475500525550575600625$650

That lumber contract has been trading for less than two years, having launched in August 2022. The CME delisted the former legacy random-length lumber futures LB00, +1.45% after the expiration of the May 2023 contracts.

The delisted contract set an intraday record high of $1,733.50 per 1,000 board feet on May 10, 2021. The delisted contract, however, had a larger contract unit sizing than its replacement.

‘Now is the perfect time to secure lumber for future upcoming jobs.’

— Steve Loebner, Sherwood Lumber

“Now is the perfect time to secure lumber for future upcoming jobs,” Loebner said. “Lumber, when adjusted for inflation, is at [or] near all-time lows” on many key items, with most of the benchmark commodity lumber items trading around 20% under the cost of production, he said.

The futures market is currently pricing lumber for extended shipping times at numbers that represent “very compelling value,” said Loebner. But lumber mills will “not continue to print huge losses indefinitely, and will be forced to further reduce output.”

Looking at the big picture, from a risk/reward standpoint, “this may be one of the best long-term buying opportunities we have seen in many years,” he said.

Residential construction

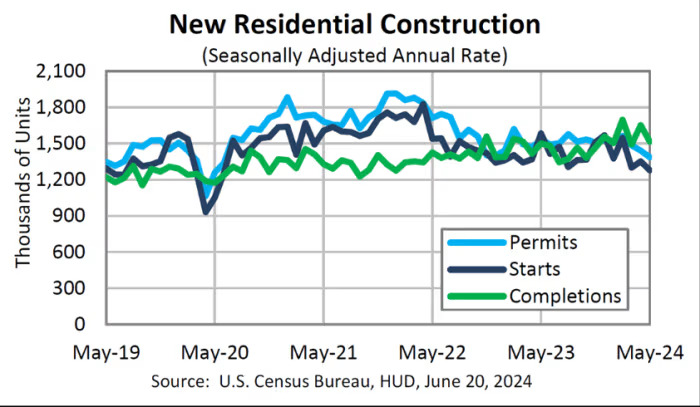

The price of lumber is most closely correlated with housing starts, said Joe Sanderson, managing director of natural resources at Domain Timber Advisors, referring to a measure of new residential construction.

With interest-rate hikes and housing starts dropping, the “market equilibrium price” for lumber has dropped to below $400 per 1,000 board feet, he said. As interest rates begin to ease, lumber prices are likely to return to the mid-$400s, said Sanderson.

Construction of new U.S. homes fell 5.5% in May to a 1.28 million annual pace, the lowest level in four years, according to the U.S. government, while building permits, a sign of future construction, fell 3.8% to a 1.39 million rate in May. Data for June will be released on July 17.

U.S. housing starts fell to a 1.28 million annual pace in May, the lowest since June 2020, government data show. U.S. Census Bureau, Department of Housing and Urban Development

It takes time, but overall affordability increases via lower rates and lower housing prices will eventually lead to a demand recovery for housing starts, said Loebner, adding that the housing market is “structurally underbuilt.”

The drop in lumber prices, meanwhile, could also spark a surge in new home-building activity, boosting inventory for buyers, said Kim Lanham, senior vice president at Mphasis Digital Risk, which provides technology solutions to the mortgage-banking industry.

That may be good news for home buyers.

Builders are “eager to make deals,” unlike private sellers, she said, adding that almost one-third of builders cut home prices in June to stimulate sales, with an average reduction of 6%.

“Builders have been cutting prices for a year, and 61% offered incentives like closing cost credits and upgrades, Lanham said. “I anticipate these trends will continue into the fall as builder sentiment declines.”

Opportunity

As for the best time to buy lumber for home building, Sanderson said that generally, the summer months of May to August see the lowest lumber prices, with raw material “readily available” and much of the demand reduced because of the summer holidays.

It’s not too late for lumber buyers to take advantage of the lower prices. Domain Timber Advisors estimates that lumber prices will remain “relatively low” through the end of the third quarter of this year, Sanderson said.

At the same time, construction-lumber demand is not likely to see any significant increase until interest rates drop, he said. “Most of the lumber suppliers have 6 [to] 8 weeks of supply on hand, plus timber contracts in place, so the general lag can be as much as 3 months.”

Homebuilders can also benefit from the low lumber prices. Lower costs can help offset homebuyer incentives offered by homebuilders, and help them maintain profit margins, said Mphasis Digital Risk’s Lanham.

Record-high lumber prices back in 2021 had significantly increased costs for homebuilders, contributing to the underperformance of the SPDR S&P Homebuilders ETF XHB. Then, as lumber prices fell, the ETF showed signs of improvement as cost pressures eased, she said. The ETF has seen a 27% one-year total return.

There’s “definitely an inverse correlation” between lumber prices and the Homebuilders ETF, but ups and downs in the lumber market are “not the sole variable” that affects the ETF, said Lanham.

As for lumber prices, Sanderson expects to see them “marginally increase” into the second half of this year.

“The political climate will need to become less volatile and interest rates will need to drop before we expect to see lumber prices increase significantly,” he said.

Based on the basic supply-and-demand fundamentals in the long term, Domain Timber Advisors sees