-

Traders use our unique Relative Price Charts to lower their lumber inventory cost and reduce their inventory risk.

-

Hedgers and lumber futures traders use them to develop basis trading opportunities and provide forward pricing to their customers.

-

Sawmills use relative price data to help manage their inventory and order file.

$1195/year | $125/mo

What we do

More than twenty-five years of lumber and futures trading confirm the fact: it’s hard to outguess the market. Win some, lose some, but the key to profitability is keeping the losses small when you’re wrong and making a sack full when you’re right.

Using Relative Prices is one of the surest ways of making that happen. If you use relative prices when you make your trading decisions, you will know which items are undervalued and which are over-valued. Under-valued items tend to go up more than the average in a bull market, but they don’t fall as quickly during a bear market. If you are right, you fill-up the sack. If you are wrong, you get a chance to get out with your shirt.

Over-valued items can take your breath away when the market falls. And they can take most of your year’s profit too. But if you eliminate over-valued items from your inventory, you’ll take a big step toward minimizing the effects of market crashes.

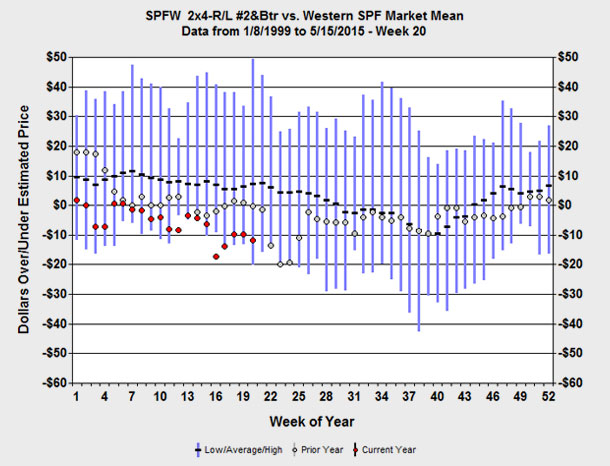

Lumber Numbers Weekly Analysis shows you which items are likely to add value to your inventory and which items are high risk. Each week we provide a Lumber Numbers Relative Value Table describing each item’s price relative to the market. Lumber Numbers Relative Price Charts provide about 200 Weekly Relative Price Charts like the one below, updated every Friday. The Lumber Numbers Weekly Report discusses the market and a few key under-valued and over-valued items.

Lumber Numbers Weekly Market Analysis includes the following

Market Analysis and Comments: The Lumber Numbers Weekly Report is a quantitative analysis of Western and Eastern Canadian SPF markets, Coastal and Inland Western US markets, and Westside, Central, and Eastside Southern Pine markets.

Example of Lumber Numbers Analysis

In the Relative Price Chart above, the vertical black bars represent the historical range (10+ years) of Southern Pine Eastside #1 2×6-16’s price, relative to the Southern Pine market average. The red line is this year’s track of the item’s price relative to the market. These charts are a unique copyrighted graphic display that clearly indicates if the item is under-valued or over-valued. They also indicate historical seasonal trends of this item’s price relative to the market. See the Quick Start Guide for more on charts.

Looking again at the #1 2×6-16′ example, in January (week 2), 1999, the red relative price line indicated #1 2×6-16′ was over-valued. We expected its price, relative to the market, would decline. From week 2 to week 26, the relative price of #1 2×6-16′ declined as expected. While the market rose a robust $107during that time, #1 2×6-16′ rose a meager $12. Owning #1 2×6-16′ didn’t give you much bang for your inventory buck.

At week 26, #1 2×6-16′ was under-valued. We expected its relative price would rise, so we thought it was good value, even though we didn’t know which way the market was going. By October (week 41), the relative price of #1 2×6-16′ had increased. From week 26 to week 41, the market fell $90, but #1 2×6-16′ rose by $40. #1 2×6-16′ showed a profit, even though the market dropped $90. That’s good inventory control.

Frequently Asked Questions

What are Relative Prices?

An item’s relative price compares its actual price to its estimated price. Its estimated price is based on the current prices of all the other items in its market. For example, if an item’s relative price is $50, it means the item is currently $50 above where we would expect it to be priced, given the prices of the other items in its market. On the other hand, if the item’s relative price is -$35, then the item’s current price is $35 below where we would expect it to be priced, given the prices of the other items in its market.

We calculate relative prices for particular sizes and grades, relative to a market average or to a base price. For example, we can look at Southern Pine Eastside, 2×10-16′ #2, relative to a Southern Pine market average. Or if we are interested in hedging using futures contracts, we can, for example, look at Western SPF 2×4 Utility relative to Western SPF 2×4 #2&Btr, the contract grade representing lumber futures contracts. Another Relative Price comparison is to compare an index of one region to another. For example, we can look at Western SPF compared to Eastern SPF or Southern Pine Eastside compared to Southern Pine Westside.

Why are Relative Prices important?

Two parts comprise an item’s price change. One is how the market is moving. The other is how the item is moving relative to the market. Research shows these two parts are equally important. An item’s price movement, relative to the market, can be as large as the market movement itself. If you are only looking at the market, you’ve only got half of the picture.

If you are bullish, you want to buy the items that are gaining on the market because they will make the most profit. If by some strange circumstance you are wrong and the market falls, these items won’t fall as fast as the market and won’t hurt you as badly.

If you are bearish, you need to get rid of the items that are losing to the market because they will go down faster in a declining market. And, if the market goes up, they won’t go up as much and you won’t realize much profit from your inventory.

Isn't market direction more important than individual prices?

Not necessarily. Our research has shown that the relative price changes of many items are equal to the overall market movement. In other words, the market may fall by 30%, but at the same time, an under-valued item may rise by about 30% relative to the market. The result is that even though the market fell sharply, the under-valued item’s price was little changed. Likewise, the market could fall by 30%, and an over-valued item might fall 30% relative to the market, making its total decline the sum of the market decline and the relative price decline combined, about a 60% decline.

Certainly, the overall market direction is important. Unfortunately, guessing the market direction is difficult and every trader knows that when he acts on that guess he is often stepping on a banana peel. Every trader should do his best at determining the market direction, but then use relative price analysis to determine the best items to buy and sell. That’s the way to get the most bang for your inventory buck and reduce your risk.

How do I view the Lumber Numbers Relative Price Charts ?

To view the Relative Price Charts, you need a current subscription, username, and a password. Click on the Lumber Numbers tab at the top of the page, click Charts, then choose the group of charts you wish to view. When you select the first item, enter your user name and password and the chart will open. If you don’t have a subscription and password, but would like to see a sample of Relative Price Charts, at the Chart Selections select Samples. No password is required.

How can treaters use Relative Prices ?

Any business with a lumber inventory should be monitoring relative prices. Most treaters build inventory for the early spring surge. Sometimes it works, sometimes it hurts. If they monitor relative prices when they start buying for that surge, they can buy and treat under-valued items that are gaining on the market. That way their inventory tends to be in high-profit potential, low-risk items. When the surge hits, their prior purchases are ready to ship and they can concentrate on treating over-valued items that were too high-risk to have in inventory. The general rule is to build inventory in under-valued items and go hand-to-mouth in over-valued items.

What is an Ideal Buying Opportunity?

An item qualifies as an Ideal Buying Opportunity when three conditions are met:

- It is under-valued.

- Its relative price is increasing, so it is gaining on the market.

- Based on the past, we expect its relative price to continue increasing.

What does it mean if an item qualifies as an Ideal Buying Opportunity (IBO)? It means the item is likely to outperform the market (in the Hedge Group, “market” means the contract grade). If the market rises, the IBO item is likely to rise faster. If the market falls, it’s not likely to fall as much as most items. It’s a good item to own because it will probably make you more money if the market rises and it may not hurt you if the market falls.

Is it a sure deal? No, it doesn’t always work. But it usually works—even though the item might follow and uncertain path in the process. As you know, this business is not about sure deals, its about stacking the odds in your favor so that by year’s end, you’ve made a decent living. This is one piece of information to help you do that.

What to do with an Ideal Buying Opportunity?

Is an Ideal Buying Opportunity (IBO) a signal to load the boat? It might be, but “relative price” information works best when combined with your assessment of “market” information.

In a bull market, you want to buy IBO items since they usually outperform most other items—they will gain more than the average and give you the most bang for your inventory dollar. IBO items outperform most items, even in a bear market, so they are less risky to own—they won’t fall as fast as the average and they might even gain. But if the market falls far enough, it will drag IBO items down with it, resulting in a loss of capital.

As a result, it’s important to consider “market” information along with “relative price” information when you are buying. The two pieces of information together help you magnify your profits and minimize your risk.

What is an Ideal Selling Opportunity?

An item qualifies as an ideal selling opportunity when three conditions are met:

- It is over-valued.

- It is losing to the market—its relative price is declining.

- Based on past relative price trends, we expect its relative price to continue declining.

What does it mean if an item qualifies as an Ideal Selling Opportunity? It means the item is likely to underperform the market (for the Hedge Group, “market” means the contract grade). If the market rises, this item is not likely to rise as fast. If the market falls, it’s likely to fall faster than most items. It’s a poor item to own because it probably won’t make you much money if the market rises and it may cost you dearly if the market falls.

Is its relative decline a sure deal? No, not all items act this way. But most do, even if they follow an uncertain path in the process. As you know, there are no sure deals in the lumber business, but you can stack the odds in your favor. This is one piece of information to help you do that.

What to do with an Ideal Selling Opportunity?

Most traders combine “market” information and “relative price” information to make buying and selling decisions. When an item qualifies as an Ideal Selling Opportunity (ISO), you can use that “relative price” information, along with your market judgment, to make a trading decision. How you use the information depends on where you are along the lumber distribution chain.

Sawmills can extend their order files of items that qualify as ISO items. They probably won’t be leaving much on the table and will maximize their sales revenue. If the market falls, they will be thankful for the extended order file.

Wholesalers, distribution yards, and retailers will want to cut their inventory of ISO items to the bone. Inventory turns and margins determine survival for these traders. ISO items, even though they may be good sellers at the moment—that’s why their relative price is so high—are likely to generate insufficient margin and turnover further down the road. You can use the current strength in these items to reduce their numbers in your inventory.